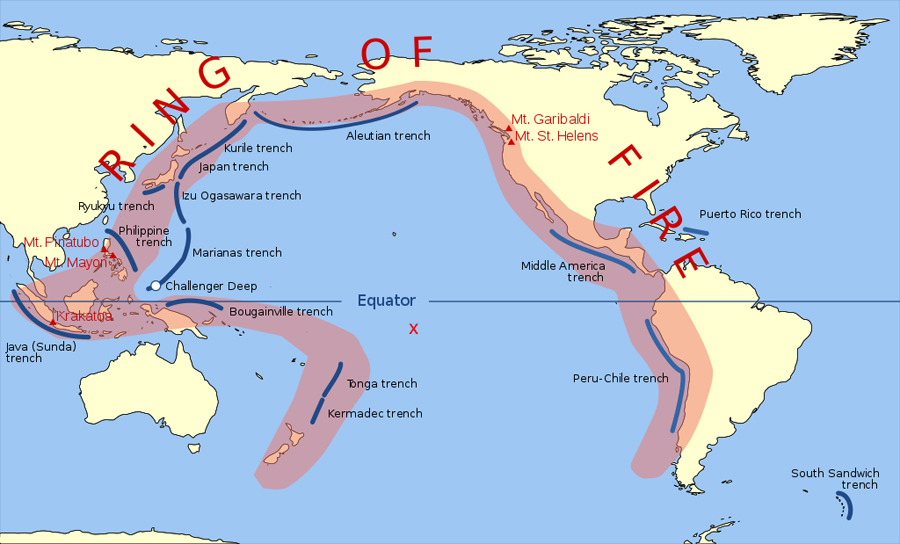

Let’s begin this post with some excitement brought about by being pretty much in the middle of the Pacific Ring of Fire: A tsunami warning. Not a drill; a warning! On March 5th (19:28:31 UTC on 4 March 2021) there was a massive 8.1 earthquake. The center was near a group of New Zealand islands called the Kermadec Islands located about 600 miles northeast of New Zealand’s North Island. This is about 3,200 km (2,000 mi) southwest of us. Should we be concerned about an event so far away? The simple answer is, yes. Let’s not forget we live on a boat.

Our marina has floating docks (or piers). The piers have a bracket wrapped around strong steel pilings allowing the dock to float up and down with the minimal tide change here about 30 cm (one foot). There is enough room for the dock to rise about one meter (3.2 ft). After this, the entire marina floats away and breaks apart. See our concern?

The arrow highlights one of the support pilings upon which the dock is attached and can float up and down with the tide change

Receiving a warning from the U.S. State Department of an imminent tsunami will get your attention every time. We (meaning Cindy) got onto the local news stations to find out more. I was completely unaware of the quake since I was away giving all of our money to a shipyard (more on this later). Lower lying areas are being evacuated according to one news outlet. But, the other channel is downplaying it.

Allow me to jog your memory about Tahiti and Mo’orea. Both islands have one main road running along the shoreline and at times the road is barely a meter above sea-level. Any rise in water is a concern. All other roads on these islands go inland and upward. They eventually dead end when the steep mountainous terrain prohibits further development.

Islanders have a tsunami plan. Like the rest of the world has fire drills, they take tsunami warnings seriously. Unlike a fire, there is time to prepare. People will place valuables and food up onto higher levels and then move uphill to safer ground. Our plan is to simply run like heck up the highest hill we can see. So the immediate question upon seeing this warning, “How bad is this?”

Not too bad, is the answer. We can expect a rise in water of up to 30 cm (about a foot). This is calculated as data from buoys in the ocean is gathered and quickly analyzed by minds brighter than mine. Within a short time, the authorities have a pretty good picture about the size of the tsunami and the speed. This is communicated to all French Polynesian islands many of which have a siren warning system. Immediately after the quake there is a period of angst while the information is gathered. “How bad is it” is the question everyone is asking.

Cindy reads we can expect the full effect of the tsunami at about 2:00 our time. An update tells her the wave will not be as big as first predicted and will be more in the range of 6 cm (2.5″). She tells me this as I arrive back aboard. We notice swirling water in the marina during this time but minimal rise.

Swirling water in the marina is not unusual this time of year. As the ocean swells come from the west or north, it causes surge in the marina. So to be honest, I am not sure if we were just seeing normal surge or the effects of the Tsunami. On a funny note; the surge has been so constant lately, I’ve noticed a Captain Jack Sparrow swagger when I walk on land now. It takes me a little while to find my land legs.

Hells bells! This has been an expensive week. March is my least favorite month when it comes to expenses. For us, it’s a doozy. Why? Our boat insurance is due and every other year, the Puffster needs bottom paint. Ouch!

Boat insurance is like no other thing on earth. It is absolutely so customer unfriendly, it is amazing. Let me explain. If you think shopping for home insurance or car insurance is bad, prepare to be enlightened. Nothing is worse than shopping for boat insurance. Having a root canal is preferable over shopping for a new boat insurance company.

The marine insurance industry is ripe for scam artists. There are known companies who have a horrid reputation, will happily take your premium and never (or rarely) pay a claim. They have a fancy internet site, offer low rates, and claim to protect your vessel against everything and anything. The old adage, if it seems too good to be true should immediately come to mind. If something bad happens, such as the Caribbean hurricanes of 2017, the company just closes shop and keeps all of the money. The answer to ensuring sound coverage from a solid company is to look up the policy underwriter(s). Keep in mind the company selling the insurance is just an agency for the underwriter. They are not the company that pays out in case of a claim. They should have a minimum of an A or preferably an A+ rating by AM Best or a AA rating from Standard & Poor’s.

The U.S. based companies are the worst. I know you’ve heard me say this more than once, we shop globally. Policies from the U.S companies are full of mice type and legalese. The layperson has no chance of really understanding their coverage. We have found reputable companies in Europe and New Zealand/Australia with easy-to-read clear policies.

When we first started to cruise, we had a policy from a reputable U.S. entity. When I read the renewal policy regarding hurricane insurance in the Caribbean and updates they made, it didn’t take me long to realize it was impossible to comply with the requirements stated in the policy. I shopped for better insurance and wound up with a great company in the United Kingdom.

The other thing driving me crazy about marine insurance is the mandate of requirements regarding the vessel. An example of this is a marine survey. A survey is performed at the owners’ expense and often involves hauling the vessel out of the water at a shipyard where a certified inspector notes the condition of the vessel and estimates a fare-market value. The surveyor notes any improprieties and the insurance company will require all of these “deficiencies” to be rectified and inspected again at the owner’s expense. The shipyard fees and surveyor costs can easily reach US$2,000.

Cream Puff being lifted in Grenada – This is what is required to lift the Puffster out of the water. As you can imagine, this isn’t cheap.

The equivalent of this craziness would be like you shopping for a new homeowner’s policy and your prospective insurance company insisting on sending plumbers, electricians, home inspectors, and engineers to examine your home in every minor detail before deciding if they want to insure you. All of this at your expense. Working with a U.S. Broker, against my better judgment, I was surprised to see another requirement in addition to the survey. They wanted a full rigging inspection. The cost of this for us would be about US$1,000. And before you write to me and tell me this is waaaay too much for a rigging inspection; let me remind you we are in Tahiti where everything is three times more expensive than just about anywhere else in the world. Do I need to remind you of the strawberries?

Gadzooks! The strawberries may be flown in but the price of over US$15/lb is not helping them fly off the shelf. Ouch!

And, not only did the U.S. company require both the survey and the rigging inspection, they also mandated 70% of the policy cost (all of which was fully due in advance) would not be refundable if we were to later cancel the policy. Needless to say, this doesn’t sit well.

When I applied for insurance with the UK company (highly recommended by a large global boating association), they did not require a survey. Instead, they asked for a few pictures of the boat. They were very specific about the photos they wanted. Basically, they wanted to see the hull from each side, the engine room, the decks, the interior, and the instrumentation at the navigation station. I signed a document stating the pictures were taken by me within the past week and were of the vessel to be insured. A receipt from our all-new rigging replaced in St Petersburg Florida more than satisfied them the rig was sound. For the value of the boat, they looked on the internet and noted our evaluation estimate was within fair market value. Why can’t U.S. marine insurance companies learn from this?

The reason I was shopping insurance companies once again was due to the wonderful British company with whom we maintained a policy for the past few years being sold. The company they sold to is also a solid company (UK and AUS based). In fact, they were my number two choice when I shopped a few years ago. I was concerned because of the change we might need to jump through some survey hoops with a new underwriter. However, this was not the case. In fact, we wound up with a better policy at a slightly lower cost.

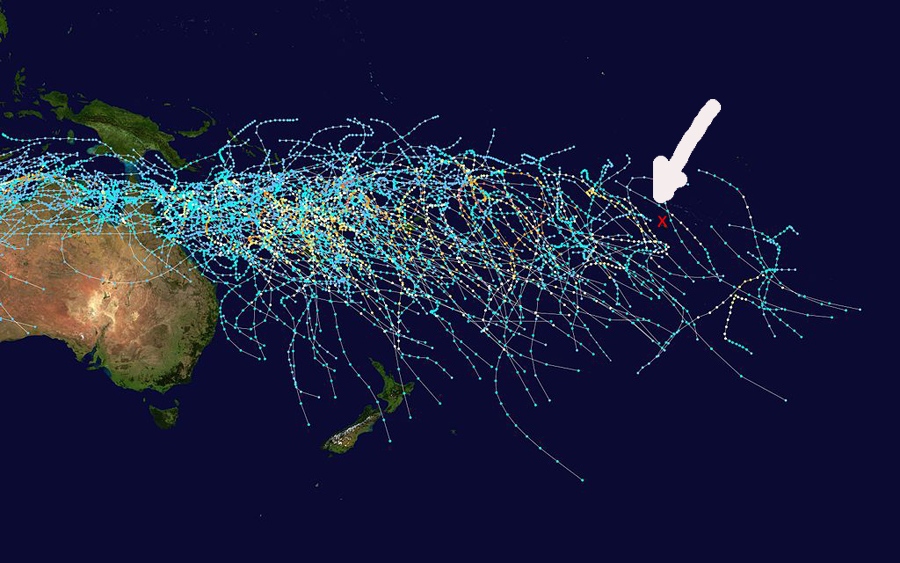

Since we are located in the South Pacific Ocean for the next couple of years, having cyclone coverage is important. Well, sort of important. It’s more of an added sweet for us. I am perfectly comfortable without hurricane or cyclone coverage on our boat. We have always lived on the boat and stayed well outside the storm belt or in an area deemed to be safer during the storm seasons. Ironically, the marine insurance companies who cover named storms usually require the vessel to be located outside of the known storm belt during the season. So, what’s the point of paying for storm coverage if they don’t allow you to be there in the first place?

In all honesty, this is like your car insurance company saying they will cover you for an accident if you are going over 50 miles per hour. They charge you accordingly. Then, in your policy is a caveat stating you are not allowed to drive on highways. If you’re shaking your head now, join the club.

This is 25 years of cyclones in the South Pacific. The red X marks the location of Tahiti. Here and most locations east of here are generally safe and out of the hot zone.

Enough about insurance! Here’s why I was at the boatyard during the tsunami excitement. I was buying paint. Every couple of years, we need to haul the boat out of the water and apply special very expensive marine paint to the underside of the boat. This special very expensive marine paint protects the fiberglass from absorbing water and helps prevent nasty things like barnacles and algae growth on the underside of the Puffster. There is a shortage of special very expensive marine paint on Tahiti.

Recently, a new French Minister decided to close all French countries to tourism. This came as a big blow to French Polynesia who has done a fantastic job of managing Covid. And, they have done so while being open for tourism with minimal mandates. Cases here are becoming far and few between and vaccinations are going full speed. This sweeping policy was a bit of a power play by France. I don’t want to get into all the politics of the situation but it was basically said if French Polynesia didn’t comply (which they didn’t want to), they would lose their funding and support from France for Covid relief. So, the flights bringing tourists stopped again.

Without tourism flights, the only option for freight to arrive on the island is by ship. All the major world shipping companies use commercial flights to move their cargo here. There is not enough to justify the expense of sending a cargo plane. I find this hard to comprehend but it is what I am told. So we are running out of stuff. Stuff like special very expensive marine paint.

While I was working on insurance, Cindy was setting up our haul out and conversing with the local shipyard. She managed to snag the last 6 gallons of special very expensive marine paint matching our existing special very expensive marine paint. In order to hold the special very expensive marine paint for us, the manager at the shipyard suggested we pay for it now to ensure it is not snagged by some other owner. So, I walked to the yard with my credit card in hand.

At the yard, I paid for the special very expensive marine paint. Sometimes it amazes me how quickly our credit card company is willing to think I can actually pay for this stuff while approving the charge. They are so gullible. I then signed the 17-page contract Cindy had negotiated for the boat work in a few weeks. I am not kidding when I say it was 17 pages. They also required an initial on every page. I have purchased homes having less paperwork than this. Seriously, why do they need 17 pages to say “We are not responsible for anything, ever!”

So, all of this now raises a pet peeve of mine. Quite often on Facebook groups or other sailing forums, people wanting to get into this lifestyle ask questions about the cost. I cannot begin to tell you how many people say they can sail full-time for about US$2,000 per month. And unfortunately, the newbie or wannabe cruiser is misled into thinking this is the true cost. When they get out here they quickly run out of money. Between our new sails a couple of months ago, our insurance, and scheduled boatyard work, we’ve just spent over US$26,000 in the past few months. On Tahiti, our average monthly grocery bill is about US$1,000 per month. And, we haven’t gone anywhere yet. Granted the sails are not an annual expense and the yard is bi-annual. My point is this is not a cheap lifestyle. Few people annualize these big expenses and break them into a monthly cost when looking at a monthly budget. If you are looking to get into this lifestyle, do some real homework and establish a realistic budget or you will be disappointed. Buy the way; our average grocery bill doesn’t include strawberries. We can’t afford them after buying special very expensive marine paint.